Executive Summary

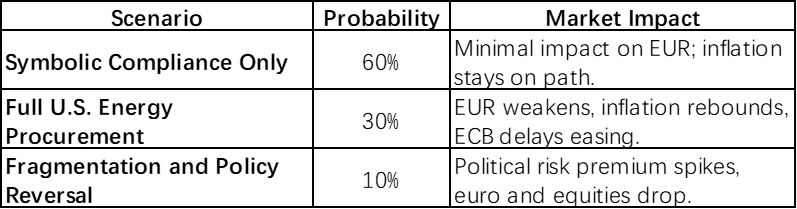

The European Union’s pivot toward large-scale U.S. energy imports—if fullyexecuted—poses potential risks to the euro’s long-term strength and global reserve role. Rising energy costscould reignite inflation, fueling political fragmentation across member states and undermining monetary cohesion.

Key Concerns

1. USD-Denominated Energy Payments Could Erode Euro’s Global Role

A significant shift to U.S. LNG and crudewould mean settling hundreds of billions in dollars annually. This increases net dollar demand, deepening Europe’s USD trade imbalance and reducing international euro liquidity.

Risk: Diminished euro invoicing and weakerEUR/USD, especially if no offsetting euro exports emerge.

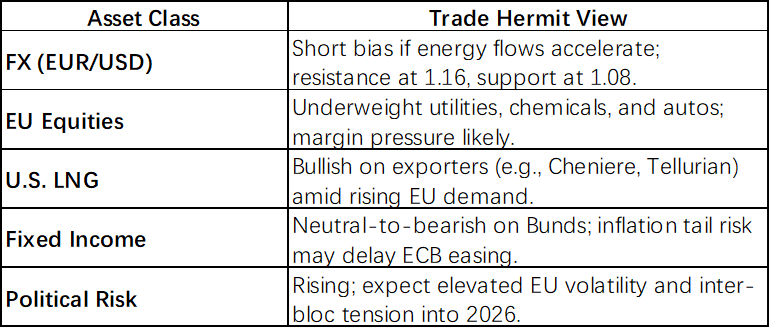

Trade Hermit View: A sustained buying program may cap EUR/USD strength near 1.16 and tilt toward 1.08–1.10 by year-end.

2. Inflation May Resurface, Especially in Energy-Sensitive Economies

U.S. LNG costs remain 25–40% higher than piped alternatives. Even under optimistic delivery timelines, the short-term impact could be elevated electricity and industrial input costs.

Trade Hermit Estimate: Potential CPI rebound to 3.5–4.0% YoY in Q1 2026, delaying ECB’s rate normalization cycle.

Investor Watchpoint: Wage inflation could follow if energy-driven cost-of-living pressures persist.

3. Political Repercussions: Populism, Not Policy Unity

Higher prices may disproportionately impact Southern and Eastern European economies, where populist movements are gaining momentum. Should inflation persist, voter backlash may increase against EU leadership.

Key Trigger: Aggressive execution by President von der Leyen could amplify the “American energy = European inflation” narrative, especially ahead of 2026 elections.

Market Implications

Strategic Scenarios

Bottom Line

The EU’s energy shift may go beyond securing supply—it may reshape macro and political dynamics across the continent. Investors should monitor actual contract execution and inflation prints closely. A hardline follow-through could reprice the euro, rewire ECB timelines, and re-ignite populist volatility into 2026.

Trade Hermit Recommendation: Hedge EUR exposure; overweight U.S. energy exporters; maintain flexibility in EU risk allocations.