Perfect Corp. (PERF) – Investment Appraisal and Valuation Report

Perfect Corp. (PERF) – Investment Appraisal and Valuation Report

Perfect Corp. (PERF) Delivers Solid Q2 Top-Line Growth

Trade Hermit - TMT Team

Current Price $1.93

Target Price $5.00

Company Profile

Perfect Corp. is an AI technology company that provides augmented reality (AR) SaaS solutions for businesses. It also offers popular apps for consumers. The company’s core competency is its virtual “try-on” technology that allows users to digitally sample beauty products (e.g. cosmetics, hair color) using a smartphone or webcam in real time. Beyond beauty, Perfect’s solutions now extend to fashion accessories (such as eyewear, jewelry, handbags, and shoes), skincare analysis and recommendations, photo and video editing tools, as well as emerging generative AI features for content creation. Headquartered in Taipei, Taiwan, Perfect Corp. operates globally, with most of its offices staffed by software engineers and sales personnel who develop the platform and support the SaaS client base. The company is listed on the New York Stock Exchange under the ticker “PERF.”

Investment Appraisal and Q2 2025 Highlights

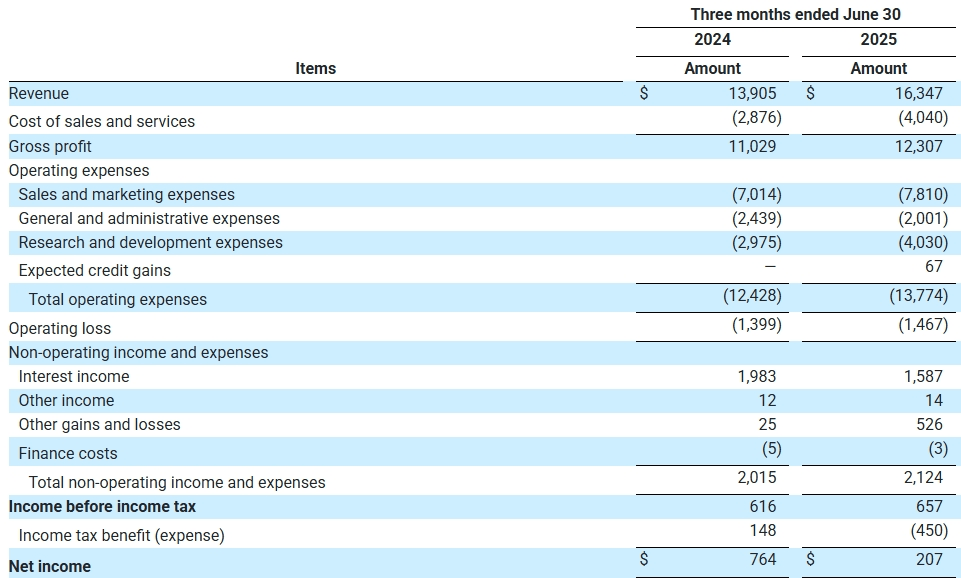

Perfect Corp. delivered solid growth in Q2 2025, with revenue of $16.3 million (up 17.6% YoY) and an adjusted EBITDA loss of $0.5 million. These results were essentially in line with expectations (vs. an estimated $16.5 million revenue and $0.4 million EBITDA gain). The revenue beat was driven by strong momentum in the company’s YouCam Perfect beauty app subscriber base, while the slight EBITDA miss was due to higher-than-expected research & development expenses. Notably, R&D costs were elevated in part by currency headwinds, as a strengthening New Taiwan dollar increased expenses for the Taiwan-based development team.

• B2C Subscribers: Paying subscribers to Perfect’s mobile/web apps reached 960,000 as of Q2’s end, a 4.4% increase YoY. This reflects robust ongoing consumer demand for the company’s features.

• B2B Clients and SKUs: The enterprise client base expanded to 818 brand clients with over 914,000 shoppable SKUs (makeup, skincare, hair, fashion, etc.), up from 686 clients and 774,000 SKUs a year ago. This broadening of B2B relationships expands Perfect’s future revenue base.

• Key B2B Customers: The number of large enterprise clients (those generating >$50K annually) stood at 139, down slightly from 151 last year. The decline was evenly split between reduced spend by some clients and outright churn amid macroeconomic pressures. Importantly, growth in the overall B2B client count is helping to offset the revenue impact of fewer “Key” customers, positioning the company for greater wallet share as corporate budgets normalize.

Management reaffirmed the full year 2025 guidance of +13% to +14.5% revenue growth. We continue to model ~13.6% growth for 2025 (about $68.4 million revenue) with adjusted EBITDA of approximately $1.6 million. Looking ahead, we forecast an acceleration in 2026 to $79.0 million in revenue (~15.4% YoY growth) and $5.9 million in adj. EBITDA, driven largely by B2C momentum. Generative AI tools, including new text-to-video and photo-to-video features, have become a major attraction for app users. However, subscriber conversion relies on the platform’s wide range of features instead of any single offering. On the B2B side, the skincare vertical remains the strongest contributor, accounting for a majority of new client leads. While most new skincare brand clients are below the “Key Customer” revenue threshold, their addition helps mitigate the decline in large enterprise customers. We believe that if the overall economy improves and interest rates lower by late 2025, business budgets could increase again. This could lead to renewed growth in the B2B segment in 2026 and further drive consolidated revenue growth.

As of June 30, 2025, Perfect Corp. had $125.3 million in cash and cash equivalents (or $167.8 million including short-term time deposits and money market funds) and no long-term debt. This debt-free, cash-rich balance sheet provides significant flexibility to invest in growth and pursue accretive acquisitions. Earlier this year, the company acquired Wannaby Inc. (branded “Wanna”), a fashion/tech innovator, which expanded Perfect’s total addressable market into categories like shoes and handbags and enhanced its virtual try-on capabilities. This acquisition exemplifies Perfect’s strategy of using M&A to broaden its platform – the combined offering now positions Perfect Corp. as a comprehensive one-stop-shop for beauty and fashion tech solutions.

Near the current share price, PERF trades at only ~1.0× enterprise value to our 2026 revenue forecast, a steep discount to peers in the tech/AI/AR space. Comparable companies trade around 6–6.5× EV/2026E revenue on average. Our $5.00 per share price target is based on a 4.8× EV/2026E revenue multiple, which is closer to (but still below) the peer average. We believe Perfect’s valuation multiple should expand as the company continues to deliver above-average revenue growth and investors gain appreciation for its strong fundamentals. In our view, the current EV/revenue gap relative to peers is unwarranted given Perfect’s growth profile, profitability outlook, and fortress balance sheet. Accordingly, we rate Perfect Corp. (PERF) shares as Outperform.

Fundamental Analysis – Score: 3.5/5.0

We assign Perfect Corp. an overall fundamental “3.5 out of 5.0” score, indicating an average fundamental profile. This assessment encompasses the company’s corporate governance and management quality, market opportunity, competitive position, operating leverage, and financial leverage. Perfect scores particularly well on its market-leading competitive position in beauty/fashion tech and its financial flexibility (bolstered by a large cash reserve and zero debt). The company also benefits from a large addressable market as brands across cosmetics, skincare, and fashion increasingly adopt AR/AI solutions. Areas that currently hold back the fundamental score include the lack of sustained operating profits. This factor could improve the rating if Perfect shifts to significant, steady profitability in the future. It’s worth noting that Perfect Corp. is founder-led and controlled: CEO Alice Chang holds a 16.5% economic ownership in the company but maintains approximately 66% of voting power through a dual-class share structure, aligning her influence with long-term strategic vision.

Valuation Summary

At present, Perfect Corp.’s stock valuation appears compelling. The shares trade at roughly 1.0× enterprise value-to-2026E revenue, a level well below that of peers. Peer technology companies (particularly in artificial intelligence and augmented reality) are trading near an average of 6× EV/2026 revenue. It is also important to note that, unlike many peers, Perfect carries no long-term debt and boasts a substantial cash balance (around $128 million as of mid-2025). This strong financial position lowers risk and enhances the company’s strategic optionality.

Our $5.00 price target is based on a valuation of approximately 4.8× EV/2026E revenue. This multiple remains conservatively below the peer group average, reflecting a prudent approach given that Perfect’s adjusted EBITDA is only expected to be mildly positive in 2025. We chose a revenue multiple framework because the company is in the early stages of profitability; however, as Perfect’s earnings grow, an EBITDA-based valuation could become relevant. For context, peers currently command lofty valuations of about 18× EV/2026E EBITDA on average. By comparison, Perfect already generates positive adjusted net income, thanks in part to interest income on its large cash reserves, and is on the cusp of sustained EBITDA profitability.

We contend that Perfect’s valuation discount relative to peers should narrow over time. The company’s above-average revenue growth, positive net income, and ability to fund growth internally (or via strategic acquisitions) all support a higher multiple than the market currently ascribes. As management executes on both organic initiatives (new product features, client wins) and inorganic opportunities (M&A to enhance its platform), investors could recalibrate their view of Perfect’s risk-reward profile. In sum, we see significant upside potential for the stock as the market recognizes Perfect Corp.’s combination of growth, improving profitability, and balance sheet strength.

Key Risks and Considerations

• Geopolitical Risk: Perfect Corp. is based in Taiwan, which faces geopolitical tensions with China. Any serious China–Taiwan conflict or instability could disrupt the company’s operations, supply chains, or investor sentiment toward the stock.

• Competitive Technology Risk: The AI/AR beauty-tech space is competitive. There is a risk that competitors (existing or new entrants) could develop superior AR/AI products or platforms, potentially diminishing Perfect’s market share or pricing power if the company fails to continue innovating at the forefront of the industry.

• Macroeconomic Risk: A worsening macroeconomic environment could lead to budget cuts or spending freezes among Perfect’s enterprise clients. Since a portion of Perfect’s revenue depends on B2B SaaS contracts with beauty and retail brands, weak economic conditions could slow the pace of client acquisition or reduce usage and expansion among existing clients. In addition, consumer spending trends can indirectly affect B2B demand for retail tech solutions.

Despite these risks, we believe Perfect Corp.’s solid financial footing and market leadership position it well to navigate challenges. The company’s diverse global client base and recurring subscription revenues provide resilience, while its continued innovation in AI and AR should help defend and grow its share in the expanding digital beauty/fashion market.